Thinking about selling your business, bringing in a new partner, or just curious about its true worth? Whatever the trigger, preparing for a business valuation isn't a passive exercise; it's a strategic undertaking that can significantly impact the outcome. A well-prepared business owner isn't just saving time and money; they're setting the stage for a more accurate, defensible, and ultimately more valuable assessment of their company.

This isn't about conjuring a number you want to hear, but about presenting your business in its clearest, most compelling light. It's about empowering you to make informed decisions, negotiate effectively, and confidently plan for your future.

At a Glance: Your Valuation Preparation Roadmap

- Define Your "Why": The purpose of your valuation dictates the scope and methods used.

- Organize Your Books: Have 3-5 years of clean, comprehensive financial statements ready.

- Identify Add-Backs: Document discretionary and non-recurring owner expenses to show true profitability.

- List Everything: Compile a detailed inventory of all business assets and liabilities.

- Gather Key Documents: Collect operational, legal, and contractual agreements.

- Know Your Market: Understand your industry, competitors, and unique value propositions.

- Be Open to Discovery: Approach the process with a realistic and objective mindset.

Why Value Your Business? More Than Just a Sale

While many immediately associate a business valuation with selling your business, its applications are far broader and equally critical. A formal valuation provides an objective estimate of your company’s economic value—a clear snapshot of its worth at a specific point in time.

Consider these common scenarios where a precise valuation becomes indispensable:

- Mergers and Acquisitions: Understanding both your and a potential target's true value is fundamental to fair negotiations.

- Partner Buy-Ins or Buy-Outs: Establishing equitable terms for incoming or exiting partners ensures smooth transitions and avoids disputes.

- Seeking Debt or Equity Financing: Lenders and investors need to understand the underlying value of the business before committing capital. For instance, obtaining an SBA loan often requires a third-party valuation to determine collateral and viability.

- Tax Planning and Compliance: Valuations are crucial for gifting shares, estate planning, and certain IRS filings.

- Adding Shareholders: If you're bringing in new shareholders, you'll need a clear method to determine the value of their shares.

- Strategic Planning: An internal valuation can help you gauge performance, identify areas for improvement, and set realistic growth targets.

- Legal Disputes: In cases of divorce or shareholder litigation, a valuation provides an impartial financial assessment.

In each instance, the valuation serves as a foundational data point, transforming speculation into substantiated facts.

The Valuator's Lens: Understanding How Value is Determined

Before diving into preparation, it helps to grasp the fundamental ways a professional valuator approaches their task. They typically employ a combination of three main methodologies, each offering a different perspective on your business's worth.

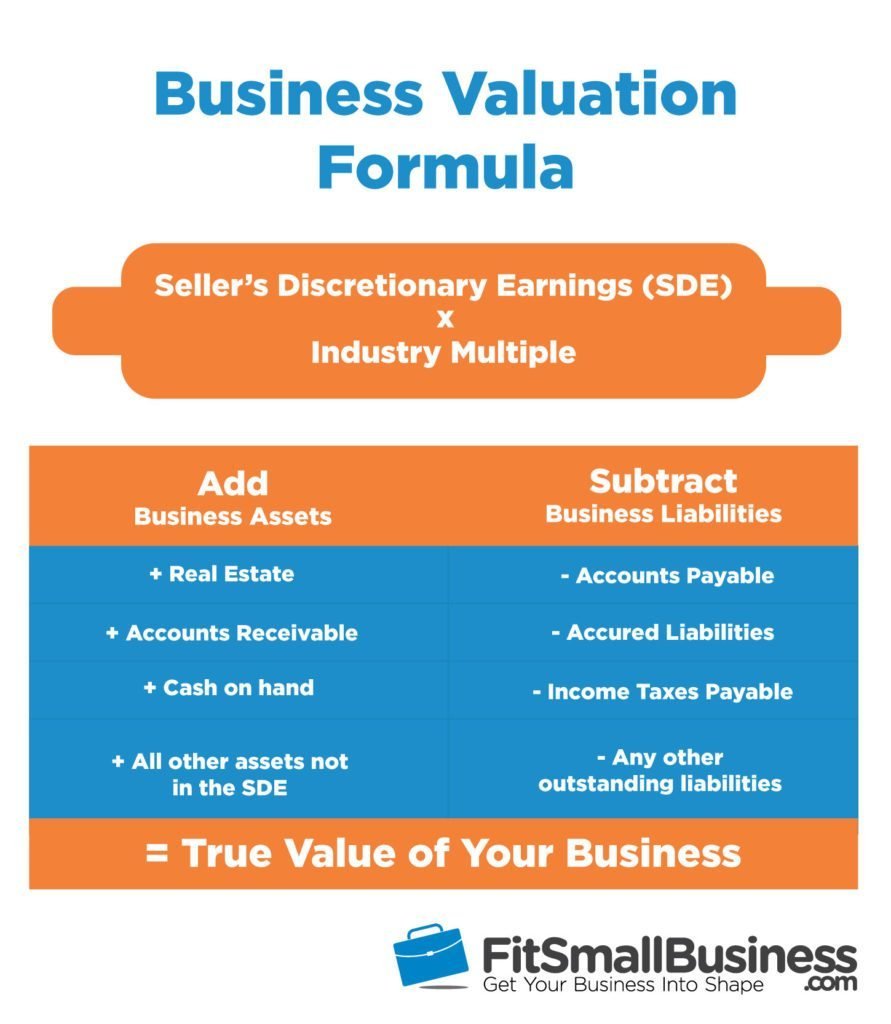

1. The Asset-Based Approach: Tallying Your Investments

This method focuses on the tangible and intangible assets of your company, minus its liabilities. It's particularly relevant for asset-heavy businesses or those with significant intellectual property.

- Book Value: This is the simplest form, directly pulled from your balance sheet. It lists total assets (like cash, inventory, property, equipment) and subtracts total liabilities (loans, accounts payable). It gives you a baseline, but often doesn't reflect market realities or future earning potential.

- Liquidation Asset-Based Approach: This method estimates the net cash you’d receive if all assets were sold off quickly and all liabilities were paid. It's a "worst-case scenario" valuation, often used by owners planning to exit under distress or for businesses that are no longer going concerns. For sole proprietorships, separating personal and business assets can be particularly challenging here.

2. The Earning Value Approach: What Your Business Can Generate

Most buyers are interested in what a business can do for them in the future. This approach assesses a company based on its ability to produce wealth.

- Capitalizing Past Earnings: Here, the valuator normalizes your past earnings (adjusting for one-time events or discretionary owner expenses) to create a representative historical earning figure. This normalized figure is then multiplied by a capitalization factor, which reflects the return a reasonable purchaser would expect on their investment.

- Discounted Future Earnings (or Cash Flow): This method projects your business's future earnings or cash flows over a specific period. These future projections are then "discounted" back to their present value, using a discount rate that accounts for the time value of money and the inherent risk of the business. It provides a forward-looking perspective, making it popular for high-growth businesses.

3. The Market Value Approach: How Do You Compare?

This approach assesses your business by comparing it to similar companies that have recently been sold in the market. It's akin to how real estate is valued.

- Comparative Analysis: Valuators look for businesses of similar size, industry, location, and operational characteristics. They then apply market multiples (e.g., a multiple of revenue or EBITDA) derived from these comparable transactions to your business.

The Golden Rule: While each method offers insights, a combination of all three is typically recommended. An experienced business valuator will determine the most appropriate methods and weightings for your specific business and purpose, providing the fairest and most accurate estimate.

Seven Strategic Steps: Your Pre-Valuation Checklist

Proper preparation is not just about making your valuator's job easier; it's about making your business look its best, ensuring no value is overlooked, and avoiding costly delays. Think of it as a rigorous self-audit that will arm you with invaluable insights.

1. Clarify Your "Why": The Purpose Shapes the Process

Before you even think about gathering documents, pause and clearly define why you need this valuation. This fundamental step dictates everything that follows, from the valuation methods employed to the level of scrutiny required.

How it impacts the valuation:

- Scope and Rigor: A valuation for internal planning might be less formal than one for IRS compliance or an acquisition. Valuations for tax purposes or an SBA loan adhere to strict guidelines and specific reporting standards.

- Methodology: If you're selling a service-based business, an earnings-focused approach might be paramount. If you're a manufacturing company with significant real estate, asset-based methods will carry more weight.

- Cost and Time: More complex purposes (e.g., litigation) often require deeper analysis and therefore greater time and expense.

Your Action: Communicate your purpose clearly and upfront with your valuator. This ensures they choose the right framework and deliver a report tailored to your needs.

2. Get Your Financial House in Order: 3–5 Years of Data

Accurate, well-organized financial statements are the bedrock of any credible valuation. Without them, the process stalls, estimates become unreliable, and your valuator will spend valuable (and expensive) time trying to piece together your history.

What to prepare:

- Profit & Loss Statements (P&Ls): Also known as Income Statements, these show your revenues, costs, and profits over a period. Provide at least three, ideally five, years of annual P&Ls, plus interim statements for the current year.

- Balance Sheets: These provide a snapshot of your company's assets, liabilities, and equity at a specific point in time. Again, three to five years of annual balance sheets are essential.

- Statements of Cash Flow: If available, these are critical for understanding how cash moves in and out of your business from operating, investing, and financing activities. Many valuators will prepare these if not available, but having them saves time. Understanding cash flow management is key to business health.

- Business Tax Returns: Provide copies of your federal and state tax returns for the same 3-5 year period. For pass-through entities (S-corps, LLCs, sole proprietorships), your personal tax returns might also be requested to reconcile certain owner-related expenses.

Why it matters: Clean, consistent books not only streamline the valuation but also project an image of a well-managed business. This is also a great opportunity to assess your business's financial health and implement best practices for small business accounting if you haven't already.

3. Uncover True Earning Power: Document Owner Add-Backs

This is where many businesses significantly enhance their perceived value. "Owner add-backs" are discretionary expenses or non-recurring items that, while legitimate business expenses, wouldn't necessarily exist or be at the same level under a different ownership structure. Identifying and properly documenting these allows the valuator to adjust your reported earnings to reflect the business's true earning power for a potential buyer.

Common add-backs include:

- Excessive Owner Salary or Perks: If the owner takes a salary significantly above market rate for their role, or runs personal expenses (e.g., car payments, club memberships, personal travel) through the business.

- One-Time Legal or Consulting Fees: Expenses related to a lawsuit, a specific consulting project, or a non-recurring event.

- Non-Recurring Income/Expenses: For example, a temporary subsidy like a PPP loan, a large one-time sale, or unusual repairs.

- Family Member Salaries: If family members are paid for roles that a new owner might consolidate or eliminate.

Your Action: Go through your P&L line by line for the past several years and identify any such items. Provide clear documentation and explanations for each add-back. Failing to do so can significantly understate your business's adjusted earnings, and thus its valuation.

4. List Every Asset, Account for Every Liability

Especially for asset-heavy companies, a comprehensive list of all business assets and liabilities is crucial. This goes beyond what's on your balance sheet and includes details that inform market value.

What to include:

- Vehicles and Equipment: Create a detailed inventory, including make, model, year, condition, and estimated market value (not just depreciated book value).

- Inventory and Supplies: Current counts and values.

- Owned or Leased Real Estate: Details of properties, lease agreements, and any associated debt.

- Accounts Receivable: Aging schedule of outstanding invoices.

- Intellectual Property: Patents, trademarks, copyrights, proprietary software, customer lists, unique processes. These are often difficult to value but can be immensely significant.

- Outstanding Loans and Liabilities: Details of all business debts, lines of credit, and other obligations.

- Contracts: Long-term supply agreements or customer contracts (covered more in the next step, but ties into assets).

Your Action: Compile these lists, ideally with supporting documentation (purchase receipts, appraisals, loan statements). Don't forget intangible assets, which can be a major source of value.

5. Gather Key Operational & Legal Documents

These documents paint a picture of your business's structure, stability, and operational efficiency. They demonstrate transparency and can significantly strengthen the credibility of your valuation report.

Key documents to prepare:

- Corporate Documents: Articles of Incorporation/Organization, bylaws, partnership agreements, operating agreements.

- Lease Agreements: For your facilities and any significant equipment.

- Customer Contracts: Samples of typical customer contracts, especially for recurring revenue streams. Information on your top 5-10 customers (anonymized if necessary) and how long they've been clients.

- Vendor Agreements: Key supplier contracts.

- Employee Information: Employee headcount, organizational chart, key employee resumes, and details on benefits plans.

- Intellectual Property Documentation: Proof of patents, trademarks, copyrights, or details of proprietary technology/processes.

- Insurance Policies: Business liability, property, and key-person insurance.

- Licenses and Permits: Any specific operational licenses required for your industry.

Your Action: Create a digital folder (or physical binder) with all these documents clearly labeled and easily accessible.

6. Know Your Place: Industry & Competitive Landscape

A business doesn't operate in a vacuum. External market conditions and your competitive positioning are just as crucial as your internal performance. Be prepared to discuss these insights with your valuator.

Consider these questions:

- Who are your top competitors? What are their strengths and weaknesses compared to yours?

- What are the current market trends affecting your industry? (e.g., technological shifts, regulatory changes, consumer behavior).

- What is your pricing power? Can you raise prices without losing significant market share?

- Do you have recurring revenue streams? How stable and predictable are they?

- What differentiates your business? (e.g., unique product, superior customer service, proprietary technology, strong brand).

- What are your barriers to entry for new competitors?

- What opportunities for growth exist?

Your Action: Be ready to articulate your business's unique selling propositions, market position, and growth potential. This narrative helps the valuator contextualize your financial performance and can justify higher multiples. This stage is also critical for crafting an exit strategy later on.

7. Set Realistic Expectations and Embrace the Uncovering

A business valuation is not merely about validating a number you have in mind. It's a comprehensive process designed to uncover a well-supported conclusion based on data, analysis, and professional judgment.

Key considerations:

- It's Objective, Not Subjective: The goal is a defensible, detailed, unbiased report that will be trusted by stakeholders (buyers, lenders, the IRS, partners).

- The Valuator is an Independent Expert: They are not there to serve as your advocate for a specific price, but rather to provide an informed opinion of value.

- Be Open to Discovery: The process might reveal aspects of your business you hadn't fully considered, both positive and negative. Embrace this as an opportunity for deeper understanding and strategic improvement.

Your Action: Approach the valuation with an open mind. Trust your valuator's process and be prepared to hear what the data truly says, rather than what you hope it says.

Beyond the Checklist: What Else Matters?

While the seven steps cover the essential documents and data, several other factors contribute significantly to a business's value and should be considered during preparation:

- Strength of Management Team: Is the business owner-dependent, or does it have a strong, capable team that can operate independently?

- Customer Concentration: Is a large percentage of revenue tied to a few key customers? Diversified customer bases are less risky and often more valuable.

- Systems and Processes: Are your operations efficient, documented, and scalable? This indicates maturity and potential for growth.

- Market Diversification: Do you serve a diverse market, or are you heavily reliant on a single niche?

- Financial Stability and Trends: Consistent profitability, positive cash flow trends, and manageable debt are strong indicators of health.

Common Pitfalls to Avoid: - Outdated or Incomplete Records: This leads to delays, higher costs, and potentially an undervalued business.

- Hiding Information: Trying to obscure issues will only erode trust and credibility when uncovered. Transparency is key.

- Emotional Attachment: While understandable, letting emotions cloud your judgment can hinder objectivity.

- DIY Valuation: Relying on simple online calculators or gut feelings can lead to significant inaccuracies.

Finding Your Guide: Choosing the Right Business Valuator

Engaging an experienced, credentialed business valuator is paramount. They possess the expertise to navigate complex financial data, apply appropriate methodologies, and provide a legally defensible report.

Look for professionals with:

- Relevant Credentials: Designations like Certified Valuation Analyst (CVA), Accredited in Business Valuation (ABV), or Accredited Senior Appraiser (ASA) signify specialized training and ethical standards.

- Industry Experience: A valuator familiar with your industry understands its unique nuances and value drivers.

- Clear Communication: They should be able to explain complex concepts clearly and guide you through the process.

- References: Ask for testimonials or references from previous clients.

Don't hesitate to interview a few candidates. Ask about their process, fees, and what they expect from you.

From Valuation to Value Creation: Your Next Steps

Once the valuation report is in hand, the real work of leveraging that knowledge begins. This isn't just a document to file away; it's a powerful tool for strategic decision-making.

- Negotiation: If you're selling, the valuation provides a strong basis for price discussions. If you're buying, it ensures you're paying a fair price.

- Strategic Planning: Use the insights to identify areas of strength to leverage and weaknesses to improve. It can inform decisions about investment, divestment, or operational changes.

- Growth Initiatives: Understanding the drivers of your business's value can help you focus resources on activities that will enhance its worth over time.

Preparing for a business valuation effectively transforms what could be a daunting process into a focused, insightful journey. By getting organized, understanding the process, and collaborating with a trusted professional, you equip yourself with the confidence and clarity to make the best decisions for your business's future.